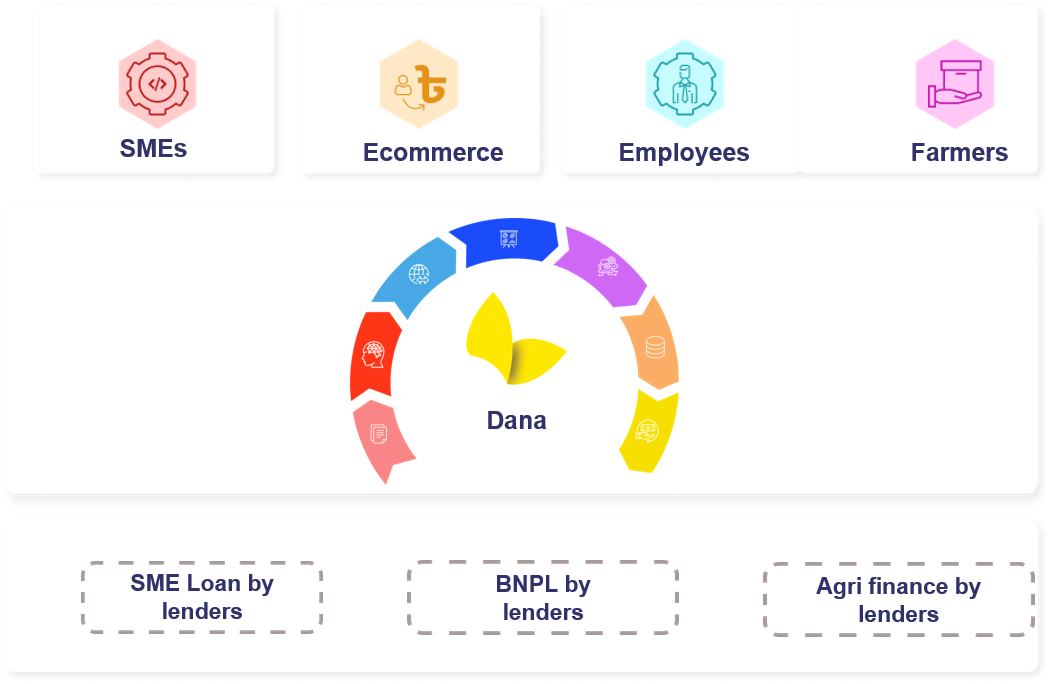

Digital lending for quick access to finance

Dana enables banks and financial institutions to assess creditworthiness of potential borrowers based on alternative data and digital credit scoring engine to extend digital loans in shortest turnaround time. With no paperwork or red tape, Dana makes the entire approval process is quick and helps lenders to scale MSME and retail loan portfolio faster at low sourcing and operation cost.

GET IN TOUCH